Bitpay And Coinbase

- BitPay and Coinbase are major points of entry known to every crypto enthusiast in the world. Even though BitPay is only a bitcoin payment processor while Coinbase is primarily a crypto exchange, the two of them have been making a lot of changes and constantly adding new features to cater to the needs of the evergrowing number of customers.

- BitPay CEO Stephen Pair explains the cryptocurrency market is starting to realize there are differences in how consumers use crypto, and it’s changing to adapt. The Coinbase Factor.

Contents

- 3 Bitpay v Coinbase Review

Coinbase and Bitpay are two established and popular cryptocurrency platforms, but there are a number of differences between them. Both platforms are outlined in detail below.

BitPay is a virtual currency processor that specializes in enabling merchant accounts to accept Bitcoin payments from customers. We have located approximately 40 negative BitPay reviews. Some of these reviews claim that the service rips off or scams merchants. BitPay (bitpay.com) rates as a solid option for merchants to accept bitcoin from customers. The service allows merchants to receive. My Contact Information -Whatsapp: +35Telegram: @brptoPayPal KYC Verified Account With Document Sale $60. Spending my crypto - CoinBase & BitPay Hi there I have an Australian CoinBase account and would like to transfer a portion to be able to spend. CoinBase currently.

It is always best to perform extensive research before committing to any platform as fees can get out of hand. The main difference is that Coinbase is an exchange and Bitpay is a Bitcoin (BTC) payment processor.

Bitpay

The aims of Bitpay are different from Coinbase. Bitpay is geared towards merchant payment processing as opposed to customers in that merchants can convert fiat currency directly if they want. Essentially, Coinbase is an exchange while Bitpay is a payment services provider which gives merchants the opportunity to accept Bitcoin as a means of payment.

In 2017 Bitpay processed more than $1 billion in BTC payments. Bitpay is currently adding support for multiple blockchains and digital currencies. Multi blockchain support is brand new and no other bitcoin payment provider has this. This will give more options to merchants as they can select the quickest and cheapest blockchain with the lowest mining fees.

They are also currently working on their platform to support transactions compatible with Segregated Witness, an upgrade to the BTC blockchain that makes it quicker and cheaper. Bitpay uses Two Factor Authentication and Google Authenticator and is quite secure.

Their aim is to reduce the price of bitcoin payments for merchants and make it as easy and smooth as possible. They have recently integrated Bitcoin Cash as well, giving merchants even more support.

If you are a merchant who wants to accept bitcoin as a form of payment, then Bitpay can definitely help. Bitpay offers guaranteed exchange rates, daily bank settlements, and flat rate pricing. They even offer an option to import Bitcoin sales to Quickbooks, an excel application useful for taxation and accounting.

Bitpay Coinbase Work Together

Most Bitcoin merchants use Bitpay for the sale of digital content, to sell travel and tourism, and to accept donations and contributions to political campaigns. Bitpay’s main competitors in the financial services space include GoCoin, Coinpayments and Bitcoin Payment Solutions (BIPS). Bitpay is currently the leader in the market.

Bitpay is the most affordable Bitcoin merchant payment processor around. Many of their options are zero transaction fees with zero hidden charges. This is unlike most cryptocurrency exchanges, which have heavy upfront charges and lots of hidden charges.

Cex.io comes to mind. What is great about Bitpay is that it eliminates price volatility during the buying process, as it guarantees the exchange rate during checkout.

And, of course, it allows for easy integration. Bitpay provides over 20 different shopping cart plugins to make it really simple. While most credit cards charge 3% per transaction,

Bitpay offers a flat 1% settlement charge for business, free up to $1000 with the starter package. In terms of receiving payments, merchants can choose eight major currencies or Bitcoin, and Bitpay supports invoicing in 40 languages.

It has never been hacked and is highly secure. Bitpay also offers a Bitcoin backed debit card. You can use it anywhere Visa is accepted, and ATM fees are currently $2 per withdrawal.

Coinbase

Coinbase is one of the largest exchanges in the world and has over 1 million active users. It is also one of the most popular and is based in the USA.

Coinbase is often called the “Goldman Sachs” of the cryptocurrency sphere because it operates much like a bank in terms of how it works and how it is regulated. It is under close scrutiny by US authorities and you can rest assured that your funds are safe in Coinbase and that if it is somehow hacked, something which has not happened in its seven years of operation, then you will be refunded. They offer the best in terms of security.

But Coinbase is loathed by many cryptocurrency purists for a number of reasons. Coinbase has close ties with banks and regulatory authorities, locks accounts for no reason and have no small amount of negative customer feedback reviews.

The founders made some very questionable political maneuvers, such as promoting Bitcoin’s main rival Ethereum, pledging support to the since failed Bitcoin classic and launching a number of ridiculous patents which go against the open source ethos.

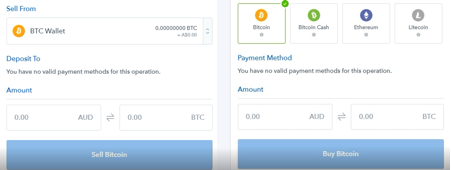

Coinbase is really just a bank that allows you to buy and store Bitcoin. It even received an $11 million investment from Bank of Tokyo Mitsubishi and is backed by many heavy financial heavyweights. Coinbase makes it easy for users to convert a portion of their incoming payments to a fiat currency as well. Coinbase also offers users a super convenient wallet service, which means one can store incoming Bitcoin transfers in BTC on the same platform. The digital currency exchange also offers Bitcoin merchant services to users.

Further, Coinbase recently suffered from a credit card glitch. After the card networks updated their mcc codes, Coinbase users were overcharged for credit card purchases. Coinbase is in the process of refunding those affected. This wallet service makes it easier than ever for users to check out and process payments quicker.

Coinbase focuses on attracting new investors to the cryptocurrency market and it does a great job. It has an amazing interface and the buying and selling experience is incredibly smooth and intuitive, something that is lacking in most other cryptocurrency exchanges.

Coinbase offers an all in one platform for the buying and selling of cryptocurrencies and is really a one-stop shop. They have their own full trading exchange called the Global Digital Asset Exchange (GDAX). The GDAX is really the main Coinbase product and their primary point of focus.

GDAX trading fees are around .025%. Coinbase charges a 3.99% fee on credit card purchases and a 1.49% fee on bank transfer payments. Expect your Bitcoin to arrive five days after a bank transfer and instantly after a credit card payment.

SEPA transfers are free and Coinbase offers high buying limits and high liquidity. Not only this, but Coinbase verification is far quicker than the majority of other large cryptocurrency exchanges.

Coinbase only supports 33 countries. You can also purchase Litecoin and Ethereum from Coinbase, as well as Bitcoin Cash.

Bitpay v Coinbase Review

Bitpay and Coinbase do different things. One of them is a cryptocurrency exchange where you can buy Bitcoin, Ethereum, Bitcoin Cash and Litecoin.

The other one is a Bitcoin merchant payment processing platform, which recently added support for Bitcoin Cash. Exchanges and payment processors are two different services entirely.

Who Accepts Bitpay

However, Coinbase is adding many plugins for merchants at a fast rate and could go down this avenue with its superior resources, eating into Bitpay’s market share. Coinbase is better known and better established in the digital currency realm, as it has more customers.

It represents an entry point into the digital currency sphere for everyday consumers. Bitpay offers a similar service to merchants.